Trusted by

Masters of consistency

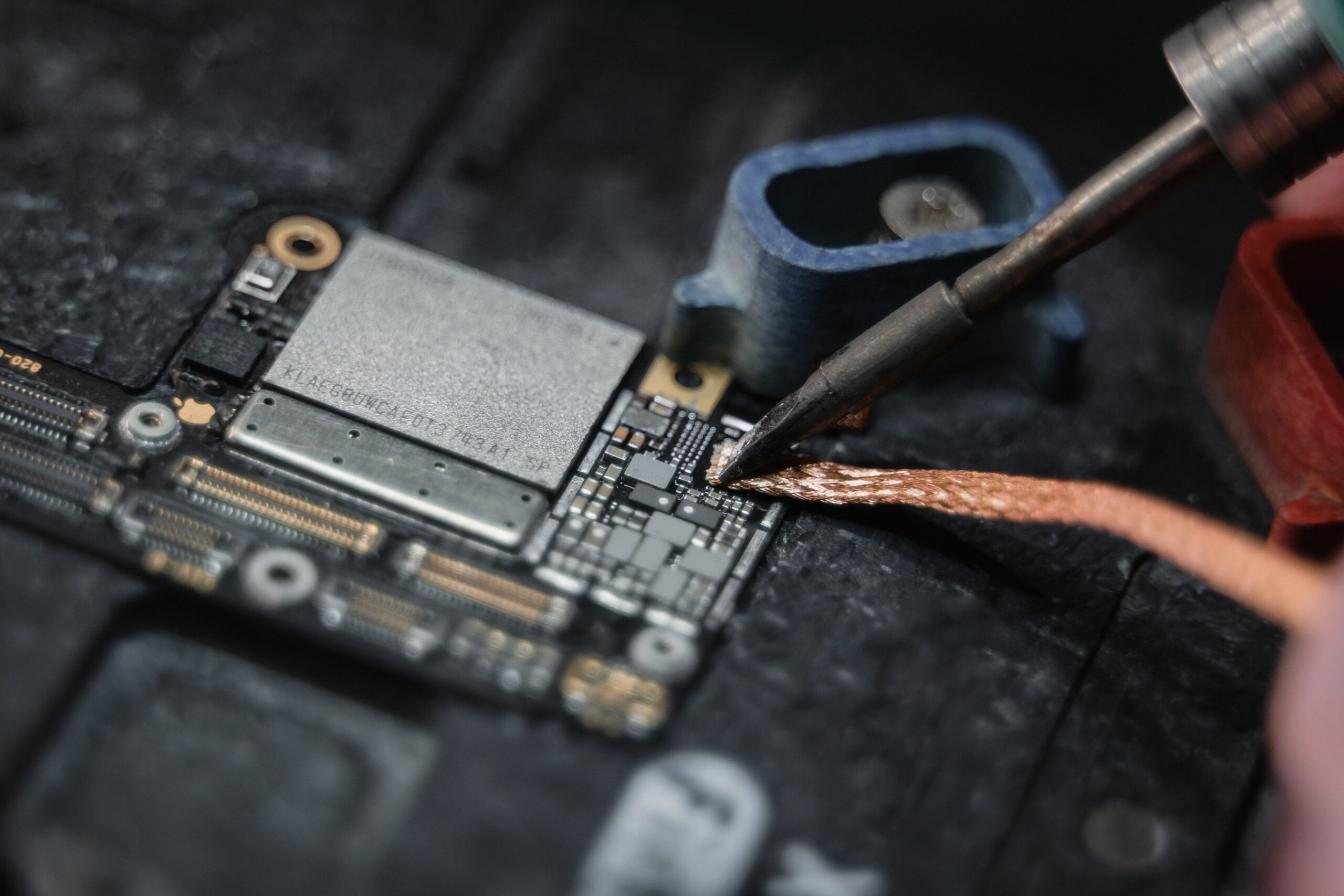

At PricelessComputer, we have been providing different types of services for decades and have one of the biggest pools of satisfied customers in the San Gabriel. Our services are ranging from Smartphones to Laptops and even change the spare parts or repair the backglass of your mobile phones with expertise.

More about23+

Years of track record in the industry.

30k+

Satisfied customers & a reputation you can trust.

95%

Success rate in repairing the difficult devices.

4.9/5

Excellent reviews from clients on Google.

The best experience

Being in the industry for many years, we know how to deal with customers with care and drafted a policy in which we take care of the clients in the best way possible thus in return we get returning customers with 5 out 5 stars on Google profile.

Get startedWhat our clients have to say

A highlight of hundreds of customer reviews from different platforms.